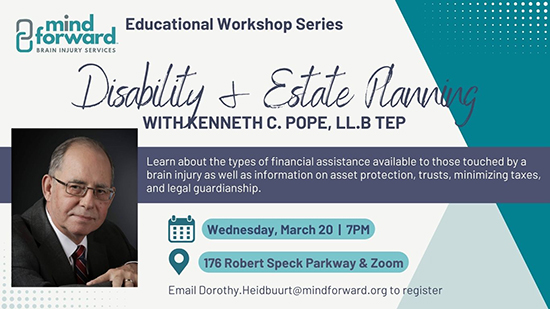

Join us on March 20th for the next workshop in our Education Series. Our guest speaker, Barrister & Solicitor Kenneth Pope, will discuss the different types of financial assistance available to those touched by brain injury such as:

- ODSP (eligibility criteria, asset limits, benefit structure, exemptions)

- Disability Tax Credit

- Caregiver Tax Credit

- Proposed Canada Disability Benefit (Bill C-22)

- RDSP (benefits, payouts, savings structure – LDAP formula, other considerations re: SDSP, AHA, Non-PGAP, PGAP)

Other topics covered will include:

- Asset protection

- How to minimize taxes

- Guardianship applications, Power of Attorney (personal & property), Substitute Decision Makers, trustees

- Pension planning with adult dependent children – eligible pension plans (provincial, statutory, OTPP, etc.)

- Henson trusts, lifetime benefits trusts (tax structure beneficiary vs the Trust, trust annuity, etc.), Qualified Disability Trusts (recent tax changes, etc.)

- Life Insurance

Kenneth Pope has practiced law in Ontario since 1980. He offers specialized support to individuals with disabilities and their families and is dedicated to providing legal, tax and estate planning services to families in Ontario and across Canada. We look forward to having Kenneth join us for an engaging and informative session and hope to see you there!